Trade Details : [private_monthly] BTO 8 KO May12 67.5 Calls STO -7 KO Feb12 67.50 Calls for a net debit of $9.48 per contract (GTC, limit order) [/private_monthly] Requirements Cost/Proceeds: $948 Option Requirement: $0 Total [Read More …]

Archives for January 2012

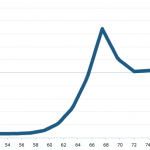

New Trade : KO

Stock / Symbol: Coca Cola / KO Price at trade post: $67.85 Option Strategy: [private_monthly]call ratio calendar spread[/private_monthly] Reasoning:[private_monthly] Since last April, KO has traded in a tight range, between a 63 and 71. We’re [Read More …]

Trade Adjustment : K

Stock / Symbol: Kellog / K Option Strategy: [private_monthly]diagonal call spread[/private_monthly] Trade entry date: Jan 6 Price at trade entry: $50.39 Price at this post: $51.55 Current Position : [private_monthly] Long 3 K Jun12 47.5 [Read More …]

Trade Adjustment : MSFT

Stock / Symbol: Microsoft / MSFT Option Strategy: [private_monthly]calendar call spread[/private_monthly] Trade entry date: Dec 23 Price at trade entry: $25.97 Price at this post: $28 Current Position:[private_monthly] Long 15 MSFT Mar12 26 Calls Short [Read More …]

Order Adjustment : K

Stock / Symbol: Kellog / K Option Strategy: [private_monthly] diagonal call spread[/private_monthly] Adjustment:[private_monthly] We didn’t get filled yesterday at $3.10, so we’re upping our bid to $3.15. [/private_monthly] Order Adjustment : [private_monthly] BTO 3 K [Read More …]

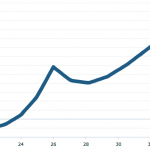

New Trade : K

Stock / Symbol: Kellog / K Price at trade post: $50.51 Option Strategy: [private_monthly]diagonal call spread[/private_monthly] Reasoning:[private_monthly] Over the past 2 years, K has traded between a low of 47.28 and a high of $57.7, [Read More …]