In this edition of The OptionWiz Weekly, we are going to provide valuable information about ETFs and ETNs.

In this edition of The OptionWiz Weekly, we are going to provide valuable information about ETFs and ETNs.

This report was written, based on our need to further explore these products following last week's move in Velocity Shares Daily 2x VIX Short-Term ETN, a.k.a TVIX.

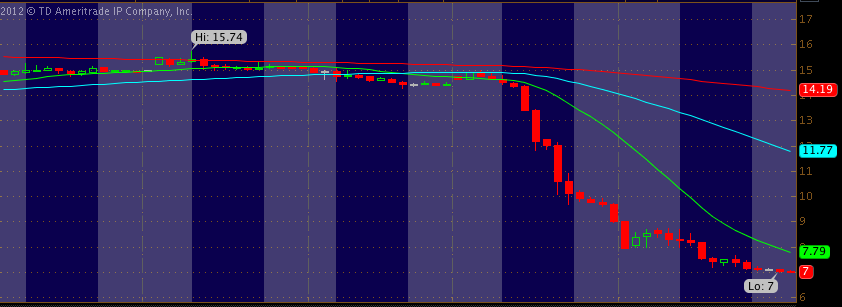

TVIX has dropped from last Monday's intra-day high of $15.07 to $5.87, where it closed today.

Our understanding was that the product would work as a hedge, should the the stock market pull back, and it would move up if volatility increased.

Last Wednesday, we were was shocked to see that while the DJIA was down more than 1%, the TVIX was going down as well. We instantly felt that there was a disconnect between our expectations of how this product was supposed to perform and what was actually occurring.

In a hurry, the TVIX fell from a high of $14.96 (pre-opening) to the low $13's.

We sold and didn't look back. However, for those people that don't have time to watch every position all day, this turned into a disaster. Right now, the TVIX is sitting at $5.87 and a there are many very angry investors complaining to its issuer, Credit Suisse.

Credit Suisse is defending TVIX, insisting that they have clearly outlined the risks of this product in the prospectus. Their prospectus states "The long-term value of your etn is zero. If you hold it as a long-term investment, it's likely that you will lose large or a portion of your investment."

Turns out, although TVIX has "2X VIX" in its title, the ETN is not tied directly to the VIX which measures the implied volatilityof the s&p 500 index options. Instead, it's tied to the VIX futures.

An Important Reminder - Always read a company's prospectus prior to investing. Don't buy anything you don't clearly understand.

TVIX Chart For The Week of 3.19.12 – 3.23.12

ETFs & ETNs

ETN

Exchange Traded Notes (ETN) are Similar to Exchange Traded Funds (ETF) , with different structures.

An Echange -traded note (ETN) is a senior, unsecured, unsubordinated debt instrument. Banks underwrite these issues and they are backed solely by the issuer's credit, and a promise of payment upon maturity. This is an added risk when compared to an ETF because if the underlying bank goes bankrupt, the investment might lose value, similar to what would happen with senior debt.

more on ETNs.....

structured products

debt securities issued by banks based on the performance of various assets, indexes and strategies

Can be purchased/sold at any time on the open market

you are buying Debt from an ETN issuer, similar to a bond investor & backed by the full faith and credit of the issuer

Like Bonds, ETNs have maturity dates that when reached a one-time payment is made based on the performance of the underlying asset, index or strategy.

For example: if you own an ETN representing Copper and the value of the Copper appreciates while you've held the ETN, you will receive a larger payment than if the value of Copper depreciates during the same period.

ETFs

An Exchange Traded Fund (ETF) is a fund that holds a basket of stocks, bonds or commodities, it trades on an exchange like a stock, and it is pegged to its real-time Net Asset Value. ETF's track many industries and indexes while carrying tax benefits and cost efficiencies.

Baskets of various assets such as stocks, bonds and commodities. In purchasing an ETF, you buy ownership of a basket and its contents can be purchased/sold at any time on the open market.

For example, if you want exposure to the retail sector and you want to be diversified, the RTH (Market Vectors ETF Tr. Retail) may be a solution.

Tax Consequences:

ETNs : Difference between the sale and purchase will be viewed as CAPITAL GAINS. ETNs have no other distributions.

ETFs: Commodity-based ETFs returns come from interest on treasury bills, short-term capital gains realized on the rolling of FUTURES CONTRACTS, and long-term capital gains.

RISKS

ETNs

if the underlying entity goes bankrupt, the investor may not receive his/her expected return.

Call Risk meaning that the issuer may call in the ETN prior to maturity.

ETFs have tracking risk, meaning that their returns will vary from their underlying index

Speak Your Mind